Trying to make ends meet in the cost of living crisis can feel truly daunting. Especially when you don’t really have a financial backup plan.

Nearly six in 10 Americans don't have enough savings to cover a $500 or $1000 unplanned expense, the new Bankrate report showed. But the surge of inflation is not going anywhere. In fact, economists say that 2023 is likely to be remembered for the sharpest drop in household incomes on record.

No wonder more and more people are forced to not just rethink their finances but to actually make practical changes. Recently, a thread on the Frugal community on Reddit shed a light on small and simple steps people make to improve their financial life. Below we wrapped up some practical advice, so grab your notes and pull your seat closer.

#1

Getting rid of Amazon prime was the best decision I made. I didn’t realize how many unnecessary purchases I had made. Also f**k Jeff Bezos.#2

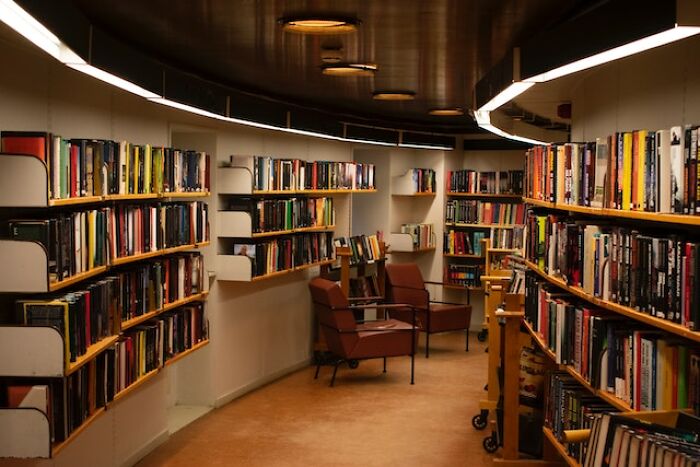

For frugal financial advice, here are a few that help me.It’s kind of a Holy Grail in this sub already, but can’t be reiterated enough - use your local library, if you can!

Create wishlists or leave the item in your cart for at least a day or two when you want to buy something online. This form of “window shopping” helps curb impulse purchases and if it is an items you actually want, you might get a discount code from the site.

Set up text or email notifications on all your accounts for any withdrawals more than $0.01. Bank account, debit cards, credit cards, etc. It helps you catch items you may be missing if you aren’t tracking your expenses already (like a streaming service you never use!) and will alert you to fraud much quicker as well.

Image credits: BohoPhoenix

#3

Make one day a week where you don’t spend any money for anything.

Image credits: Oscarcharliezulu

#4

I joined a Buy Nothing Group on Facebook and the gifting community has been amazing. I was able to furnish a room in my apartment from gifted items.

Image credits: simplicityx29

#5

I make my own bread. I probably eat way too much of it but I use the no knead method and it’s easy.

Image credits: anon

#6

Unsubscribing from sale notifications worked really well for meIf I'm considering an impulse purchase I really think about if and how much I'd use it, where I'd keep it, and if I actually need it

Image credits: KatHatary

#7

I bought a steel coffee filter so I could stop buying paper ones (honestly a petty amount of money to save but hey it’s also better for the environment), clipped more coupons from both digital and online sources, invested more money.

Image credits: gothiclg

#8

Group buy / batch cookI dedicate one weekend a month to massive batch cooking to stuff the freezer with easy to make, healthy meals during busy weeknights. It’s usually all family members on deck to help.

If you can coordinate with a few friends, agree on a few recipes that everyone would like in their freezer, you can usually get better cost per unit when you buy in bulk. Then, fire up the tunes, break out the wine or beverages of choice and cook your a*s off with your friends.

My buddy and I banged out a large vat of home made sauce, 8 large pan lasagnas and a hundred stuffed shells in a weekend…and it was insanely cheap AND healthier than the high fructose corn syrup s**t in jars.

Image credits: TheSpatulaOfLove

#9

I started selling a bunch of stuff on eBay/FB market place and really digging into my “am i ever reallllyyyy guna use/wear this?”

Image credits: Plastic_Border4357

#10

I seldom use trash bags or paper towels. I reuse grocery bags and use sponges / rags instead of paper towels. It adds up…I don’t use smell good stuff for my laundry. Dryer sheets and those unstoppable are so expensive.

I also re wear my clothes a few times- unless it’s dirty/undies and socks.

My friends spend an ungodly amount on beauty stuff. Nails, hair, eyebrows, makeup. It is crazy. I’ll get a haircut every so often, never ever get my nails or eyebrows done and buy dollar tree makeup and a 5$ mascara.

This may get looked down upon, but I don’t like going out.. I’d much rather stay at home

#11

Item 5 in your list reminded me of something an old colleague told me about: have an annual house maintenance calendar full of lots of preventative jobs to do at specific points through the year.Usual things like clearing out your gutters, jet washing the patio, etc, life admin tasks like renewing annual insurance policies, but then also things I'd never think about doing like pulling all the furniture/storage boxes etc away from external walls every autumn/spring to check for damp/mold.

I can't say I've actually put anything as regimented as this in place myself ? but it sounds like a good idea!

Image credits: do_you_realise

#12

I chose one day a month to treat myself with a fancy coffee/ fast food- whatever. This way I could not just randomly decide today was the day and then forget and do it another day and before you know it you’ve spent $100 on dunkin. So one a month. When I got more financially secure I’d choose 2 and now I am at Fridays. On Fridays I can buy a drink or a treat.This does not include takeout food necessary for a meal. These are treats that are highly unnecessary and a waste of money…… but for some reason people love to do it

Image credits: lulu-bell

#13

I balance my accounts daily. It takes 5 minutes max, and it helps me see exactly what's coming and going, what's expected, and where I'm at. It makes keeping on track really, really, easy.

Image credits: chicklette

#14

To avoid allowing myself to purchase unnecessary things, I made a note on my phone with links to everything I wanted to buy. Occasionally I would spend a long time saving up for those things. Often times, months would pass and when I had money to buy something from the list, I decided I didn’t really want it anymore. This has meant I only buy something extra for myself once every couple of months. This helped my self control, my wallet, and gave me perspective on what’s important.

Image credits: MistRoot

#15

Mine was setting up my direct deposit for a portion to go right to my savings before it hits my checking so I don't see it. You can either do a percentage or a set amount. I do a set amount and when I get a raise, I up the amount a little. Currently, I have $200 go to my savings and the remainder hit my checking. I learned to live without that $200 as if I am not getting it, and my checking is $400 to $600 more per month depending on how many paychecks I get a month. I realize that many don't make enough to di this, but I started with $50. Got a small raise and upped it to $75. Got a promotion with a 30% raise and then put it at $125, etc.#16

Just googling “website coupon code” whenever I am about to make a purchase that has a coupon code space to enter. Just bought lift tickets to ski and saw that section. Opened a new browser and searched for it. Found one that gave me $25 off. It worked and took me about 3 minutes to find.

Image credits: stinky_pinky_brain

#17

As soon as my car was paid off, I took half the payment I was making and put it into a 'car savings account' to be used on repairs of my car or hopefully build up to the point that replacing my vehicle was relatively painless. Eventually, the repair for the car was not worth it and I still was able to get a decent trade in value for it, combined with my savings, my monthly budget didn't change at all.When interest rates were low, I refinanced the house. Rather than a cash out like all of the cool people were doing, I just changed it to a 15 year instead of a 30 year mortgage. I will save well over 6 figures in interest, my payments really didn't change by much. Also, the equity is there if I need it for emergencies but I am not paying interest on money I don't need to borrow.

Image credits: jmilred

#18

Using a credit union instead of a bank. Game changing in terms of low / no fees and low / no minimum balance.If an article of clothing you like loses a button or gets a small tear or the hem comes undone, your dry cleaner will probably fix it for a couple of dollars. This is way better than throwing it out or waiting months / years until you get around to mending it yourself for free. For plain buttons, they probably have a close match if you lost it, or there may be hidden extra buttons sewn in. If the buttons are more custom color or shape, move a matching button from the bottom and replace the bottom button with a close match.

Image credits: Odd-Independent6177

#19

Here’s my 11 tips:1. learning the names of basic over the counter medications (example: acetaminophen, ibuprofen, Dimenhydrinate) and then reading labels and buying the generic version (store brands)

2. Using natural products for skin care instead of spending tons of $$$ on “beauty” products that have toxic ingredients to boot (example of basics: vitamin E and Witch-Hazel)

3. Buy classic well made pieces of clothing that I can wear in many ways and take care of them and they last for years instead of 10x more pieces that are trendy and cheaply made and fall apart. Granted this is difficult now. I have kept good clothes, outerwear and footwear for decades and I shop second hand, vintage and also sew and alter.

4. Buy all of my shelf stable pantry and other household items at a bulk store.

5. Meal plan and make leftover meals and actually eat leftovers. I like them. Many dishes taste better the next day. Looking up recipes for what you have on hand is great for this too.

6. Rarely (as in once in a blue moon if I am super stuck on long trips and have no choice) eat fast food or at take-out junk food places. I’ve been doing this all my life because firstly I don’t like it (was raised on healthy food and find it gross) and secondly it’s a massive waste of money. I bring homemade wherever I go if I need to eat during the day in a small lunch cooler or heatables. I worked for years with people that spent a small fortune ordering out. If you add it up over the course of a week or month, it’s insane how much it costs.

7. I schedule my driving around for errands to be done all in one day or in chunks on a couple of spread out days and plan my route so I am not driving around multiple times all over the place more than I have to. This saves not only gas money but on my time which is actually frugally precious to me and wear and tear on my vehicle and just annoyance and these days adding to possible accidents from all the crazy drivers.

8. I do like some of the good things like certain foods and drinks but I find that there’s not much of a difference between an $8 bottle of wine and a $30+ bottle. So, if I want wine, I am perfectly good with one of the more cheapy labels that I know I like the taste of. I rarely go out socially where I would order a drink and will stick to one or two at most. And funnily enough, (or maybe because of that - was more of the party animal in my 20s- I still have a blast.

9. I also like to keep a nice home. Frugal doesn’t mean cheap or shoddy to me. But, I am not caught up with “designer” products. Those are actually just marketing ploys. I keep an eye out at discount stores and major box retailers for home goods, especially after major holidays for items that I might need to replace. For example, I found a set of stemless wine glasses with pine trees and elk theme at a discount store nearby for $6. The same or similar at a trendy place would cost probably 5x as much or more. I got them because we have breakage, though (I have developed Parkinson’s and can’t use the stemmed ones) not just because it was a deal.

10. Always put some untouchable money aside for emergencies and retirement, starting even in our late twenties with 2 little kids. We were both always self employed - my husband as his own business owner and me after being a SAHM working independently in the arts, so it was tight. But, it made a huge difference.

11) We love books and spent so much on them over the course of our lives, but they have gotten ridiculous in price since long ago and they add to clutter. We sold all of our paperbacks and gave most of the hardbacks away except for my resource books and cookbooks and history classics.

My husband gets all his books from the local library and I only use Audible or read for free online.

Image credits: MartiMcMoose

#20

My entire house has been supplied by thrift store and Craigslist finds: dishes, area rugs, sheets $2, dressers $25, bed $100, toaster $5, blender $5, pots and pans $75, towels $2.50 ea, kitchen table and chairs $25, silver ware $8, etc.All items match, coordinate, function and/or are quality made. Tons of fun finding them, memories and feelings of treasures found linger as I am surrounded by them. I’ve found them most of the time within a days outing in search of each one. Because they are in such good shape, I imagine they are from people moving, or donated during estate liquidation ext.

Seriously, Americans have so much stuff there is no need to buy new.

Image credits: MeanderingMoonMaiden

#21

Pretty much stopped drinking - that saved me a ton. Coffee at home. I actually prefer picnics to eating out and my family has gradually followed. I almost never eat take-away, so I suppose learning to cook is savings measure. Do lots of little jobs around the house rather than hire someone. Hanging a picture in WA practically requires a construction crew because of the brick walls.#22

Some of my bigger savings are from:* Riding bus & bike instead of driving (though we’re a one-car family now b/c kids)

* Biking also eliminates the need for a gym membership

* Watching stuff on YouTube instead of cable / subscriptions

* Day trips instead of overnight trips

* Filling thermoses with coffee/tea that I make in the morning to take wherever I’m going

* Brewing my own iced tea to keep in the fridge instead of juices, sodas, etc

#23

The one about social media got me. I’ve deleted tik tok and Instagram over the least year and I find I’m spending a lot less on bs things I don’t need that I saw on an advertisement (I’m a highly influential millennial)

Image credits: Excellent_Plankton89

#24

I've adopted "productive" hobbies. I love baking and crocheting. I love drawing and painting, but haven't had the time to sit down and commit to the creative process. With my new hobbies I can come back to a project or finish a recipe in short time. I've become alright at making sourdough fruit loaf and I'm making my kids cute and quirky beanies.#25

For me I have a really bad issue with buying cheap (and sometimes expensive) snacks whilst on my lunch break. Like I’ll go to the market by my job for a bag of chips and get a $2 bag sometimes because it’s $2…whatever, y’know?Well, that adds up. Especially if I’m already planning on buying a lunch.

So on days where I grab the bag but then decide to put it back on the shelf, I immediately move that $2 to my savings. It definitely adds up over time, especially if it’s a more expensive snack like a $5 bag of chips, or a $8 pastry. If I could theoretically afford it in that moment, then I can definitely afford to send that money to my savings.

Image credits: shipping_addict

#26

What helped me is leaving my credit card and cash at home when I go out.

Image credits: Artistic_Operation_2

#27

I’ve gotten rid of all but one of my streaming services and I rotate through them and binge watch. So Netflix for a couple of months, prime for a couple of months, then Apple etc…And I don’t buy takeaway coffee.

#28

Consider Roth IRA for some off your savings. No tax deduction when investing but tax advantaged when withdrawing

Image credits: wh0wants2kn0w

#29

Giving myself pocket money.Without a doubt this stopped frivolous spending.

I give myself a small amount of pocket money every week out of my paycheck and I'm allowed to spend it 100% guilt free on anything I want.

It helped me save so much money as I saw all my money as mine and available for spending. Now I love saving up my pocket money to high amounts to buy special things, or just save.

Totally changed my view on the value of money and I've never saved so much in my life as now.

#30

i make it a game to NOT pay for prime or accept their offers. no, jeff- f**k you. youre getting THIS $50+order until i give you another.

Image credits: socalmikester

#31

Meal plan. If you meal plan and have the food on hand it is less likely you will be tempted to eat outShop for clothes at Goodwill and other charity shops

#32

Easy one, don't look poor! I know it's rough and hard... but present yourself well.#33

As a formerly homeless and currently disabled single mother, I know about making ends meet. I suggest always making a shopping list and always sticking to it. Planning meals within your budget is vital. My food budget is less than $3-5 a day total for my entire family. Parents, if you too are plagued with worry about feeding your kids what's worked for me, is "fasting for the future."When "fasting for the future " it's highly suggested to skip at least 2 meals a day, while always eating any and all leftover scraps from the meals being skipped ...but still above all else always still being fed regularly the children to reduce waist and ease hunger /hypoglycemia when "fasting for the future " , as I call it. Fasting for the future will ultimately result in fatigue and malnutrition, but think of the growing children and their health and development, the choice becomes clear. So compensate yourself by budgeting in at least $10+ monthly for yourself minimum, as you will need it. Remember, you can't pour from an empty cup as a parent, so always eat the scraps. No matter how meager. Trust me. Rice and beans are filling and nutrient dense. Dried beans soaked overnight and simmered with a meat bone can be Devine. ONLY purchase produce in season. Oatmeal, pancakes, peanut butter, and jelly are also great low-cost meals overall. Call 211 for local free food centers and utilize them as much as possible

Think 3 times before spending. Do I need this? Is this a smart purchase? Will I get buyers' remorse? Purchase mixes and bake at home to save money. Or even better learn to cook from scratch. Choose recipes with very few ingredients to avoid expensive meals. Or plan meals around what you have on hand. Googling, for example, " corn, beans, and canned chicken recipe," and peruse your culinary options. Thinking and planning ahead are essential.

Other options to save money are simply not to spend money. Look for free swap style rummage sales like junk in the trunk, etc. Go on free local facebook pages. Utilize any and all resources from non-profit organizations. By wearing the same clothing, even though you lost 60 pounds, you can save a ton of money. We survive off of less than $1k month for a family of 4. I'm wearing my boots another winter even though there are holes in the bottom of them where the heel has worn down and my socks get wet. That's $50+ saved for an emergency or another expense.

Image credits: Moe3kids

#34

Old school- when using cash don’t pay exact. Change into a jar . Yeah not much but do this for a few years - you never know :)Edited - I forget the app that is designed for this …

Image credits: Mid_AM

#35

11. I cannot stress enough how little i really needed all the things ive ever ordered from amazon it’s easy to rationalize it like oh it ends up paying for itself and all the free shipping and I can get groceries and whatever you Gotta tell yourself but at the end of the day you go back and look at your history and you think damn that was a waste. That was a waste. That was a waste.#36

"f**k you money" envelope. I use my debit card for only my normal expenses. I pull a small amount out of every paycheck and put it in my "f**k you money" envelope. Separate from savings, etc. This is my money I use to buy beer or go to the bar, buy s**t I don't need, hobby stuff, etc. It's seriously cut down on my impulse spending when I have to go grab cash to do it. But when I find a stupid project or thing I want, there's usually money there to do it.But the main part is not impulse buying stuff. Having to go get the cash and having a finite amount where if you do too much one month you have less the next, really cuts this down.

#37

Food preservation, learning to cook using quality but inexpensive ingredients (and how to source quality but inexpensive ingredients), focusing on trying to limit food waste as much as possible. Especially with food costs right now, it's so nice to be able to plan an entire week's worth of meals for two adults that only need about $30-$40 worth of stuff from the grocery store.#38

Spreadsheet everything and set goals, track spending, look for places you can save.#39

I set up a free account with Intuit’s Mint budgeting app. I review it constantly to see where my mine is going and see where we can cut back expenses.

Image credits: Caroline_Anne

#40

I download the apps for stores that I frequent/semi frequent to my phone but turn off notifications. When I'm out at the store and I see something that is a want (not a need/need right now) I will use the apps barcode scanner, if it has one, and quickly add the item to a wish list/shopping list for later.I can then look at my budget, see if it's affordable and if so when. I also have time now to think over the item without the pressure of being in the store and having the item in my hands/right in front of me. Comparison shopping is also a plus.

Speaking of apps, I turned notifications for 90% of mine off...including most social media. If I'm mentioned in a post, yes let me know, otherwise I will view Twitter/Instagram/TikTok when I feel the need. Honestly I hardly check most SM platforms because I forget about them, so the lack of notifications really helps.

As a bonus, the mental load off of not seeing a milling notifications helps a lot. My phone is for calls and texts FIRST, everything else is second.

#41

set everything to autopay. my bills are always paid on time and my savings and roth contributions are less painful bc they happen automatically on payday. the money is accounted for before i can accidentally overspend. i manage to save $600 a month on my $60k gross income this way. i’ve had to cut back on eating out, fancy groceries, and entertainment but it’s been worth it to have money for retirement and emergencies. i picked up a temporary weekend side hustle to save extra for home repairs and self-care splurges like a facial.#42

Making an excel sheet for tracking ALL expenses. Separate excel sheets each for - grocery (food only), non-grocery (clothes, accessories, toiletries, etc.) , entertainment (takeout, movies, subscriptions, hobbies, etc.) and non-negotiable items (rent, phone, utilities, insurance, etc.).Every time there was a non-essential purchase (especially in the entertainment category), I would write the dollar amount in red ink on a blank piece of paper and add it to a jar. At the end of the year, I would see how much "money" was in the red-jar. Then I would move that much money out of our accounts and into an account that cannot be easily touched and assume that I had "lost" that money to frivolities. Then, the SO and I worked to bring down that amount in the red-jar.

Over time... we got rid off ALL subscription channels, cable, alcohol is down to one bottle a year (it's not like we were guzzling before that, but we brought it ALL the way down to "once a year treat" section), no movies or concerts or games, etc. in the past 7+ years now. We have so much more time to spend with each other and a lot more money saved for whatever...

#43

If people had an extra 500 a month to put into a fund, I don't think they'd be so financially f****d but okay#44

Yes to cancelling Prime. I deleted my Amazon account about 4 years ago. My impulsive spending went down so significantly.Got off social media this year. Zero ‘omg you have to buy this immediately’ moments so far this year.

Meal prepping is my next one.

#45

>What are some maybe out-of-the box things that have helped you get your money together?I started following this sub.

The Subscribe and Save program helps me stay stocked and save money on general household items. Coupled with my Amazon Prime Visa, where I get 5% back in rewards for everything I buy on Amazon, I feel like I've made my money work for me. The trick is to pay it off every month, and since my order is never more than $100, it's not very hard.

I think the most off the wall thing I did to save money was stop taking vitamins. I care about my health and at some point convinced myself I needed a ridiculous amount of supplements to be healthy. They were costing easily $50-75 a month, and I was always looking for something new to step it up. I finally quit cold turkey and honestly feel just as good. I put the saved money toward extra payments on loans and have cut down my debt significantly.

Image credits: stonerd808

#46

I don’t see “make more money” on here. There’s an infinite supply of money in the world, but a limited supply of personal resources to cut or save.

Image credits: johnfromberkeley

#47

If you cancel Amazon Prime and you used an Amazon Rewards credit card, make sure you switch your Amazon payment to another rewards credit card (like Discover). Amazon credit cards don't pay rewards if you don't have Amazon Prime. And if you use your Discover cash back rewards to pay for stuff on Amazon you get 40% off, up to $20.

Image credits: LowBarometer

#48

“Max out IRA” can seem challenging, it’s just unfamiliar to most people. It was difficult for me to figure out too.“Invest in real estate” I don’t even think this is good advice for most people. I’m a professional that make good money and it still doesn’t make finance sense for me.

As for frugal tips (the real question here lol): I spend most of time focusing on learning skills. I get enjoyment out of seeing my progression in the craft and obviously the benefits from it. The trick is you have to make it fun for yourself. Almost anything can be fun tbh. Create an environment of no pressures and encourage exploration.

Take cooking for example. Not everyone does it because it’s work for them, but some people find it fun. Why is that? For me, it’s fun because I get to try out new techniques and see the result of it. I would make same meals different ways just to see the result. I also put no pressure myself by cooking on a full stomach. I’m not in a rush to get things done. It’s ok to make mistakes or have things come out bad because who care as long as I’m learning.

Obviously this cost money too, but it’s very little compare to other hobbies. You can also make it cheap by not spending money on every new shiny tools and just make things work with what you have. The constraints is part of the challenge. Cooking is just one example m, you can apply this principle to anything. I apply it a lot at work to learn new skills that make me more money. Lately I’m learning how to detail cars lol

Image credits: JimmyWu21

#49

I have limited my subscriptions and expenses to the bare minimum that i can say i have a good quality of life.- Sam’s club membership: $120.00 a year

- YouTube premium (for the add free videos and music library) you basically get music streaming for free with premium.: $13.00 a month

- Car extended warranty: $120ish a month

- Phone lines: $120 for four lines and 2 hotspots a month

- Internet: $79.00 a month

- Car wash membership: $35.00 a month

- car insurance: $500.00 every 6 months

- utilities: $200.00ish a month

-insurances like house and medical: $230ish a month

- Roth IRA: $500.00 a month

- 45% of my check goes to my savings

-No streaming services I use free services like pluto tv

- no mortgage or rent i build my own house using my savings since i was 16.

- no car payments: bough with cash.

Food and other expenses like “fun money” varies but generally they are low. I don’t really go out a lot and i cook at home.

My monthly income is $3,200.00

So yeah, looking at this i feel like i live a boring life but i am happy. I buy everything used or second handed and i try to entertain myself with hobbies or side hustles. I try to live frugal, when I splurge i like to do it with friends and family.

#50

Meal prepping#51

Keeping a "Maybe" box in my closet for donations#52

The dollars and cents stores always have crazy bargains in them. Packets of sweet biscuits or noodles for 50c, boxes of dishwashing tablets for quarter of the price, bulk batteries for a couple of dollars. I have a cupboard at home where all the specials or bulk purchases go when I get a good deal.Grocery rewards cards add up too, and if you find a docket where a rewards card wasn’t used, you can take it in and get it put on yours. I make about $20 per week from this. The freebies the stores give out for each $30 spend (little plastic toys, cards, legos) I save and sell on eBay. I line up behind large shoppers without kids who may not want theirs, and ask if I could take them instead. Approximately $2 profit per free item there. Recently one of the stores had some gorgeous glasswares you could exchange for points. I have 7 double packs of fancy glasses in the cupboard ($70 value each) that can be engraved for gifts and special occasions.

I love all the ideas on here, and it makes a huge difference mentally having some change in your pockets.

#53

Adding ...-12. Buy a quality espresso machine w/ a good bean grinder

-13. Set-up a happy hour lounge where you perfect your go-to cocktail

-14. Order your beef direct from the rancher

Each of these cut 50 to 70% off the retail purchase prices.

Image credits: williehoward

#54

HYSA for emergency fund. Now that interest rates are up this nets me more interest in a month than my credit union did in a year.#55

Well...Now to avoid impulse buys, all I leave the house with is cash. 80 bucks tops. Unless I'm planning on getting gas, then I'll take my one credit card that has some cash back.

I have a serious problem with impulse shopping, and shopping A LOT. Carrying cash is my short time solution. I'll get to a help group soon.

#56

I buy/eat from the sales at my local grocery store. I use coupons. If I can't get %50 off I don't usually buy it. for example, when Spaghetti sauce goes on sale, I buy as many as I can usually 4. I use it for spaghetti, pasta dishes, pizza, breadsticks etc (always buying pasta in bulk on sale and making my own pizza dough).I often buy from the the clearance racks and I buy 3 Sunday papers for the coupons and use them. stay organized and use [couponmom.com](https://couponmom.com).#57

Start budgeting if you haven’t already! I was so aimless before and stressed hoping I had enough money for all my bills. Now I know exactly where every dollar is going.I recommend YNAB.com (You Need A Budget). It’s $80 a year but 100% worth it. Also some of the other free budgeting tools sell your data and solicit other products to you.

#58

Ah, number 7. I struggle so with this. I am on FB for family. I have an unused tumbler. I use insta for amusement. My Twitter I gave up last year.Reddit however, is the best. We moved to another state, and researched a lot before and after our move. We got valuable information and contacts. It's literally saved us time and money.

Reddit has been a springboard for ideas and conversations around the dinner table.

I'll eventually lose the rest but, keeping Reddit.